Asset Protection

"It takes a great deal of boldness and a great deal of caution to make a great fortune; and when you have got it, it requires ten times as much wit to keep it"

Nathan Mayer Rothschild (1777-1836)

Asset Protection

Asset Protection is about more than establishing a trust or a foundation. While we will most often make use of either or both in a combination in a structure, it is important to identify the risks and then establish a strategy to manage them and protect against them.

Your own personal goals will also have to be taken into consideration because the risks you would be facing if you are simply building up wealth to retire comfortably will be very different from the ones facing a dynasty trust destined to live for generations.

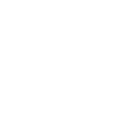

Trust

A trust can best be described as a legal arrangement (a legal form) through which the legal ownership of assets is transferred to the trustee in order to keep these assets for the benefit of others (the beneficiaries).

We see a great interest in Private Trust Companies which is set-up to manage one or several trusts from the same family and whereby family members may be on the Board and take part in the management.

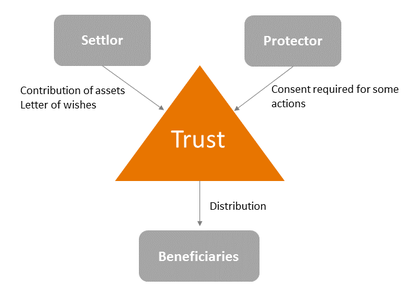

Foundation

In some jurisdictions a foundation is known as a family foundation and in others as a private foundation. Foundations can be used in a similar way to trusts, such as for wealth protection, privacy and wealth planning, but originally only existed in civil-law countries.

Nowadays, some common-law countries also offer the option of setting up foundations, for example, Jersey and Guernsey, in addition to the more established alternatives from Liechtenstein, St. Vincent and Panama.

Family Office

A family office can be a useful tool in your legacy planning and it excellent for introducing the next generation to your structure and values.

A professional family office or multi-family office offers services such as wealth planning, administration, asset management, asset consolidation, asset performance monitoring, charity services, tax and legal services, trusteeship and risk management. These services are either offered in-house or the family office cooperates with dedicated external partners. What a family office could also offer is to organise your travel arrangements, provide insurance solutions, manage your yacht or help you invest in private equity or manage real estate .

A family office can also manage your corporate (holding) structure and your private investment structure and assist in setting up wealth protection or other wealth planning structures. In most cases wealth management, wealth planning and safeguarding your assets are at the core of the services which are provided. However, the services to be provided by your Family Office is tailored to your requirements and your personal preferences.

A multi-family office would share some ressources with other family offices but is completely segregated and confidential.