Trusts

____________________________________________________________________________________________________________________________________________________________________________________

A trust can best be described as a legal arrangement (a legal form) through which the legal ownership of assets is transferred to the trustee in order to keep these assets for the benefit of others (the beneficiaries); the equitable ownership of the assets is thus deemed to be held by the beneficiaries. Trusts are established based on the trust law of common-law countries and date back to the time of the Crusades. Although trusts are a common-law structure, the trust and trustee(s) can be based in Switzerland.

What sort of trust do I need?

Trusts come in various forms.

A “bare trust” arrangement is where a trustee holds the legal title of an asset or assets on trust for a person or persons, where the trustee has no discretion and must follow the instructions of the beneficial owner. A bare trust can be a useful tool to preserve the anonymity of the beneficial owner.

A “life interest trust” or “interest in possession trust” is where a trustee holds the legal title of an asset or assets on trust for the benefit of a person or persons where beneficiaries’ interests are defined. For example a trustee of a life interest trust may be obliged to pay all or part of the income of the trust to the beneficiary holding the life interest, known as the “life tenant”, for the rest of the life tenant’s life.

A “discretionary trust” is where a trustee holds the legal title of an asset or assets on trust for the benefit of named beneficiaries where their interests are not defined. Therefore, the trustee has discretion whether to pay income or capital to the beneficiaries in accordance with the terms of the trust deed and with regard to the needs of the beneficiaries and the wishes of the settlor. A settlor’s wishes are often set out in a document or series of documents know as “letters of wishes”.

There are other sorts of trust, such as “purpose trusts” where the trust deed does not name beneficiaries but sets out an objective or purpose for the trustees to follow. The most common use of purpose is to hold shares of a limited company, in many cases the shares of the Private Trust Company.

Who plays which role in a trust?

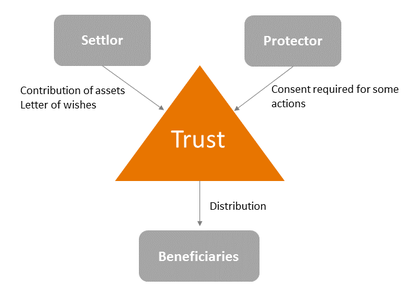

The person establishing a trust is called the settlor. The person or company managing and legally owning the trust’s assets is called the trustee; very often, a multi-family office acts as the trustee. The trustee controls and manages the assets, but the beneficiaries are entitled to all (the benefits of) the assets and profits of all property held by the trust. The settlor informs the trustee of his wishes as regards the management of the trust in the so-called “letter of wishes”. In most cases, these are non-binding instructions to the trustee about the management of the contributed assets and potential distributions to beneficiaries.

The settlor often also appoints a protector. A protector is, in short, someone who checks the (acts of the) trustee on behalf of the settlor or someone who may, for certain decisions, act as an advisor to the trustee. Normally the protector is somebody in whom the settlor has every confidence. A multi-family office could act as trustee of the family's trust, or could fulfil the role of a protector.

Do you think a Trust may be solution for you and your family? Get in touch for a confidential and complimentary dicsussion. You can contact us here

____________________________________________________________________________________________________________________________________________________________________________________